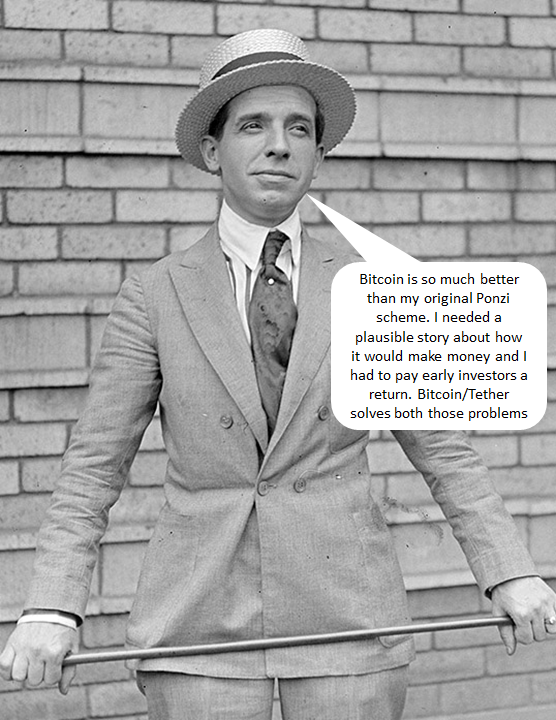

Impossible Finance : From Ponzi to Bitcoin — The Perfection of the Scam

Guest writer and financial innovator Charles Ponzi explains the genius of Bitcoin

My name is Charles Ponzi, you have probably heard my name because I was one of greatest financial geniuses of the twentieth century. My name is commonly applied to many innovative forms of finance but you may not be familiar with all the details of my story.

It really all began in 1919. I had had a thorough apprenticeship in business before setting up my investment scheme. After arriving in North America I worked as a waiter, bank manager, thief and forger but it was banking that really inspired me. While working at Banco Zarossi in the charming city of Montreal, I learned from the CEO that if you guaranteed higher returns than alternative investments people would literally force you to take their money.

Many people at the time thought that guaranteeing higher than market returns was the path to ruin, after all how could you guarantee that you would earn higher returns? This “in-the-box” thinking is typical of the conventional thinker. The clever solution is to pay investors attractive returns from the investments of the next wave of investors. This creates a virtuous circle where paying out the promised returns attracts ever more investors which allows you to continue paying out returns and attract even more investors. The key thing is to run away with the cash before you run out of investors.

I used to write a lot in those days, often back to Mama in the old country. My familiarity with international postage gave me a deep insight into the economics of “International Reply Coupons”. When I wrote to Mama I realised that I could send her one of these coupons, which she could exchange for stamps in Italy, without having to pay. Then I discovered that coupons bought in most of Europe where much cheaper than coupons bought in the United States or more importantly the value of the American stamps a European coupon could be exchanged for. All you needed to do to become rich was buy coupons in Europe, send them to the US, exchange for American stamps and then somehow pocket the difference in value. That was the theory but I never quite figured out how to do it. The great thing about finance though was it did not matter. All that mattered was that the story was believable.

Within a few months I was taking in millions of dollars per week. Investors were being paid superb returns. I bought a mansion, my own bank and paid for Mama to come to America in style with her own state room on the liner. Like any successful businessman I did experience some problems from the jealous fools in the press. One claimed it was impossible for me to be generating such high returns, so I sued the scoundrel for libel and won half a million dollars! Even then America knew how to protect financial innovators from what are today called “FUDsters”. Things got tougher though, some people started doubting me and withdrew funds, I tell you I started to worry. Then in July 1920 the press saved me, they reported in glowing terms about my genius and high returns and the money started flowing in again, faster than ever.

The good times did not last though. The owner of the Boston Post let his son, Richard Grozier run it. Now Richard must have been some kind of communist who did not believe in the free market because he hired an investigative journalist called Clarence Barron to look at my scheme. Barron was even more of a fool than Grozier. He said my scheme was unethical because it was taking money from the government. How can taking money from the government ever be unethical? He also made up some nonsense about the numbers not adding up. He was the kind of fool who thought that just because 1+1=2, a thousand years ago it meant it had to add up the same in 1920. Madness, it was the radio age, why should we have been bound by ancient mathematics.

Well, people started taking their money out of the scheme so I hired a public relations guy. After all, the only thing wrong with my scheme was that people had stopped believing in my story, and it was the story that was going to make me and the investors rich, not stupid numbers. Well the PR guy was a Judas, he stole information from me and sold it to the newspaper. Then it all fell to pieces, I lost everything and went to prison. Without all those awful people interfering in free market I would have made enough money to run away before the scheme collapsed. Which takes us to Bitcoin.

Now these Bitcoins are currently selling for almost $26,000 dollars as a result of a scheme far cleverer than anything I came up with. Firstly there is no obvious person to investigate and lock up, it was all created by a mystery man called Satoshi Nakamoto. Unlike my scheme there is no need to pay any return to investors, they simply buy Bitcoin because they believe the price will just keep going up and up and up. There is of course of story to make people buy. The first story was the Bitcoin was going to revolutionise payments. Sadly Bitcoin is terrible for payments, the technology is slow and awful and it relies on a made-up form of money nobody really wants to use for ordinary commerce. But someone, maybe the son or daughter of Satoshi came up with a brilliant new story. Bitcoin’s utility came from being a “store of value”, a form of digital gold. Bitcoin had value because people said it had value, amazingly hundreds of thousands of people including some big businessmen believed this.

No need to pay a return and a great story that could not be disproved made an amazing combination but there was a still a flaw in the scheme. If people wanted to take profits from their Bitcoin investment it meant they had to sell some Bitcoin. Selling Bitcoin caused the price to fall, which is not great if it is supposed to be a store of value. If there is a financial crisis and a lot of people need to sell Bitcoin in return for real money the price collapses as it did in March 2020. The first attempt to stop foolish people (who were not in on the scam) from selling was something called “HODL”, a strange internet spelling of the word “Hold”. The idea was that if you invest in Bitcoin or any other cryptocurrency you should never ever sell it because the prices would climb forever.

That worked to varying degrees of success for a few years but it was ultimately replaced by something called “Tether”, a large unsupervised bank that issued its own money. Tether’s dollars were supposed to be worth one US dollar and backed by a dollar in a bank account. Or at least it was until Tether admitted they were only backed by about 74 cents of assets per Tether. It gets better though because even though Tether resembles a bank because it takes deposits it is not regulated like a bank and has never been audited. So every time the Bitcoin price is falling more Tether are created to buy Bitcoin and the price goes up. If people want to cash out they seem happy to take Tethers instead of real money. Everyone is happy. A small number of “whales” and exchanges make billions of real dollars while investors believe they are rich in Bitcoin and Tethers, unless of course they stop believing in the Bitcoin story or the Tether story.

This time most of the press just report changes in the value of Bitcoin as though it was something real and most regulators simply sit on their hands rather than interfere in the free market. Overall it is a truly great time to be alive for financial innovators or as we called them in the twenties, fraudsters. Sadly I died in 1949, blind, poor and close to friendless after spending much of my life in prison. Good luck guys!